Top 5 Best ELSS Funds for 2025: The Ultimate Tax-Saving & Wealth-Building Guide

Quick Facts

- What is ELSS? An Equity-Linked Savings Scheme (ELSS) is a type of mutual fund that invests at least 80% of its money in the stock market.

- Primary Benefit: It offers a dual advantage: a tax deduction of up to ₹1.5 lakh under Section 80C and the potential for high, inflation-beating returns.

- Key Feature: It has a 3-year lock-in period, the shortest among all tax-saving instruments.

It’s that time of year. The “tax-saving season” is in full swing, and your inbox is likely flooded with “Invest now to save tax!” emails. For many, this is a stressful, last-minute scramble to park ₹1.5 lakh into anything that qualifies for a Section 80C deduction.

But what if I told you that you’re looking at it all wrong?

Tax saving shouldn’t be an expense—it should be an opportunity. It’s the one time the government actively pays you (in the form of a tax rebate) to build your own wealth. And in 2025, no other instrument blends tax-saving with wealth creation better than the Equity-Linked Savings Scheme (ELSS).

After analyzing over 35 ELSS funds, we’ve identified the top 5 funds poised to deliver for 2025 and beyond.

The best ELSS funds for 2025 based on consistent performance, risk management, and low expense ratios are:

- Quant ELSS Tax Saver Fund

- Parag Parikh ELSS Tax Saver Fund

- Mirae Asset ELSS Tax Saver Fund

- DSP ELSS Tax Saver Fund

- SBI ELSS Tax Saver Fund

In this comprehensive guide, we’ll do a deep dive into each fund. But more importantly, I’ll show you how to choose the right one for you.

Table of contents

- What is an ELSS Fund, and Why Bother in 2025?

- Our Methodology: How We Picked the Top 5

- Deep Dive: The Top 5 Best ELSS Funds for 2025

- At-a-Glance: The 5 Best ELSS Funds Compared (Data Table)

- How to Choose the Right ELSS Fund for You (A 4-Step Guide)

- How to Invest in an ELSS Fund (Step-by-Step Guide)

- The “Gotchas”: Common ELSS Mistakes to Avoid in 2025

- Frequently Asked Questions (FAQs)

What is an ELSS Fund, and Why Bother in 2025?

Let’s get this out of the way. An ELSS is a mutual fund, plain and simple. It takes your money and invests it in a basket of stocks. But it has three magic ingredients:

- Tax Deduction: Your investment (up to ₹1.5 lakh/year) is deductible from your gross taxable income under Section 80C. If you’re in the 30% tax bracket, that’s a straight ₹46,800 back in your pocket.

- 3-Year Lock-in: You cannot touch your money for 3 years. This sounds like a downside, but it’s a blessing in disguise. It forces you to be a long-term investor and ride out market volatility, which is the only proven way to make money in equities.

- Equity Returns: Unlike your PPF or Tax-Saver FD, this money is working hard for you in the Indian stock market, giving you the potential to earn 12-15% (or more) over the long run, comfortably beating inflation.

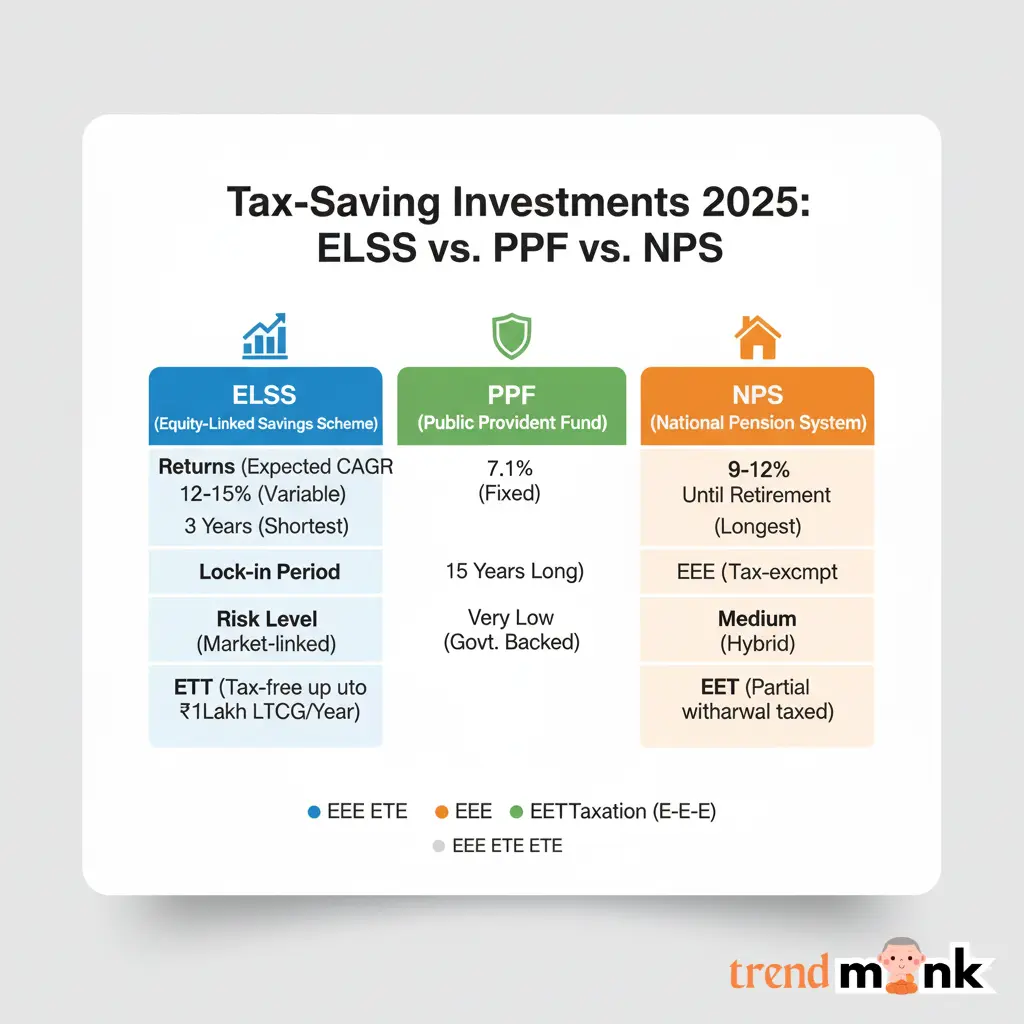

Why ELSS Beats Other Tax-Savers (PPF, FD)

I love the Public Provident Fund (PPF) for its safety. But for a young investor, it’s a wealth-creation drag.

Look at the facts:

| Feature | ELSS (Equity-Linked Savings Scheme) | PPF (Public Provident Fund) | Tax-Saver FD |

| Risk | High (Market-linked) | Risk-Free (Govt. backed) | Risk-Free (Insured) |

| Returns | ~12-15% (Historical CAGR, not fixed) | 7.1% (Fixed by Govt.) | ~6.5-7.5% (Fixed by bank) |

| Lock-in | 3 Years (Shortest) | 15 Years (Very long) | 5 Years |

| Taxation | ET (Invest up to ₹1.5L exempt, gains >₹1L taxed at 10%) | EEE (Fully tax-free) | ET (Invest up to ₹1.5L exempt, interest is fully taxable) |

The verdict is clear: PPF and FDs are for capital protection. ELSS is for wealth creation. The 3-year lock-in is a small price to pay for the potential to have your tax-saving money actually grow faster than inflation.

“Investors, especially those under 40, must view Section 80C as a wealth-building tool, not a tax-disposal chore. The 3-year lock-in of ELSS is its greatest feature; it enforces the discipline that 90% of retail investors lack, protecting them from their own short-term panic.”

— Priya Sharma, SEBI-Registered Investment Adviser (RIA)

Our Methodology: How We Picked the Top 5

Picking a “top fund” isn’t about looking at last year’s #1 performer. That’s called “rear-view mirror investing.” Our analysis is built on a more robust, forward-looking framework:

- Long-Term Consistency: We prioritized 5-year and 7-year rolling returns over simple 1-year trailing returns. This shows how a fund performed across different market cycles (bull, bear, and flat).

- Risk-Adjusted Returns (Sharpe Ratio): It’s easy to get high returns by taking high risks. The Sharpe ratio tells us which fund manager delivered the best returns for the amount of risk taken. A higher ratio is better.

- Fund Management & Philosophy: Is there a stable fund manager at the helm? Does the fund stick to its stated strategy (e.g., large-cap vs. flexi-cap) or chase whatever is “hot”?

- Expense Ratio (Direct Plans): We only consider Direct Plans. A lower expense ratio means more of your money stays invested, compounding for you.11 All funds on this list have competitive expense ratios.

- AUM & Fund Age: We looked for funds with an established track record (ideally 5+ years) and a healthy Assets Under Management (AUM). AUM that is too small can be inefficient; AUM that is too large can sometimes make a fund less agile.

Deep Dive: The Top 5 Best ELSS Funds for 2025

Here is our detailed analysis of the top 5 picks for the 2025 investment season.

(All data as of November 2025, based on Direct-Growth plans)

1. Quant ELSS Tax Saver Fund (The Aggressive Growth Engine)

- Best For: The high-risk, high-return investor.

- Direct Answer: This fund is for investors with a 5-7+ year horizon who can stomach significant volatility in exchange for potentially chart-topping returns.

This fund is an outlier in every sense. The Quant AMC operates on a proprietary quantitative model (VLRT) that is dynamic and aggressive. It’s not a “buy and hold” fund; it has a very high turnover ratio, meaning it buys and sells stocks frequently based on market momentum, value, and risk signals.

The results? It has been the undisputed #1 performer over the last 5-year period. But this performance comes with a “Very High” risk tag. This fund will fall harder than others in a market crash, but it has historically recovered much faster.

- 5-Year CAGR: ~27.8%

- Expense Ratio: ~0.57%

- Fund Manager: Ankit Pande

- Strategy: Dynamic/Quantitative, high-turnover, multi-cap.

- Top Holdings: Reliance Industries, L&T, Adani Power

- Verdict: This is my personal pick, but I have a high-risk appetite and a 10-year horizon. Do not make this your first and only ELSS fund. It’s a fantastic “satellite” holding to boost your long-term returns.

2. Parag Parikh ELSS Tax Saver Fund (The Prudent Value Choice)

- Best For: The thinking investor who wants growth with lower volatility.

- Direct Answer: This is the ideal fund for a moderate-risk investor who believes in a value-oriented, “buy and hold” philosophy.

From the high-octane Quant, we move to the incredibly prudent Parag Parikh. This fund is relatively new (launched in 2019) but comes from a fund house renowned for its flagship, the Parag Parikh Flexi Cap Fund.

Its philosophy is simple: buy good companies at reasonable prices and hold them for the long term. It has a low turnover and a focus on quality. What’s most impressive are its risk-adjusted returns. It has consistently shown a high Sharpe ratio and low volatility, meaning you get a “smoother ride” for your equity investment.

- 3-Year CAGR: ~17.3% (Fund is newer, so 5-yr data is emerging)

- 5-Year CAGR: ~21.6%

- Expense Ratio: ~0.62%

- Fund Manager: Rajeev Thakkar

- Strategy: Value-oriented, low-turnover, flexi-cap.

- Top Holdings: HDFC Bank, Bajaj Holdings, ICICI Bank

- Verdict: This is quickly becoming a core holding for many smart investors. If you’re nervous about the “Very High Risk” of other funds but still want equity growth, this is arguably your best and safest bet in the ELSS category.

3. Mirae Asset ELSS Tax Saver Fund (The Large-Cap Stalwart)

- Best For: First-time equity investors and conservative investors.

- Direct Answer: If you want a reliable, steady, large-cap-focused ELSS fund from a globally respected AMC, this is it.

The Mirae Asset ELSS fund is a classic. It’s a giant in the category with over ₹27,000 Cr in AUM. This size and its investment style make it a “stalwart.” The fund is managed by the highly-regarded Neelesh Surana and has a strong bias towards large-cap, blue-chip companies.

This means it won’t be the #1 performer in a roaring bull market (like Quant), but it will also likely fall less in a downturn. It’s a well-diversified, stable, and highly consistent fund. You’re unlikely to be disappointed, and you’re unlikely to get a negative surprise.

- 5-Year CAGR: ~20.4%

- Expense Ratio: ~0.56%

- Fund Manager: Neelesh Surana

- Strategy: Large-cap bias, growth at a reasonable price (GARP).

- Top Holdings: HDFC Bank, ICICI Bank, Infosys, Reliance Industries

- Verdict: This is the perfect “first-time” ELSS fund. If you’re just starting your equity journey and are nervous about risk, Mirae Asset provides a high-quality, stable, and reliable entry point.

4. DSP ELSS Tax Saver Fund (The All-Weather Performer)

- Best For: The “set it and forget it” long-term SIP investor.

- Direct Answer: This is a well-diversified, all-weather fund with a proven track record across multiple market cycles.

The DSP ELSS fund is another long-term favorite. It doesn’t take massive sectoral bets. Instead, it maintains a well-diversified portfolio across large, mid, and small-cap stocks (a true “flexi-cap” or “multi-cap” approach).

This “all-weather” strategy means it aims to perform respectably in all market conditions. It has one of the longest, most consistent track records in the business. The fund’s AUM is large (~₹16,000 Cr), indicating a high level of investor trust. It’s the definition of a “core” holding.

- 5-Year CAGR: ~23.3%

- Expense Ratio: ~0.64%

- Fund Manager: Aparna Karnik

- Strategy: Multi-cap, blend of growth and value.

- Top Holdings: HDFC Bank, ICICI Bank, L&T, Infosys

- Verdict: If you don’t want to think too hard, you just want to start a monthly SIP for the next 10 years, the DSP ELSS Tax Saver is an outstanding and reliable choice.

5. SBI ELSS Tax Saver Fund (The Legacy Blue-Chip Fund)

- Best For: Investors who value the trust and brand of SBI.

- Direct Answer: A solid, blue-chip-focused fund from India’s largest and most-trusted AMC.

You can’t have a “top 5” list in India without mentioning SBI. The SBI ELSS Tax Saver Fund (part of the merged SBI Long Term Equity Fund) is a legacy fund with a massive AUM and the trust of millions.

Its strategy is similar to Mirae’s: a strong large-cap bias, focusing on India’s biggest and best companies. Its expense ratio is slightly higher than the others on this list, but its performance has remained strong. For many investors, the peace of mind that comes with the “SBI” brand is worth the slightly higher fee.

- 5-Year CAGR: ~25.4%

- Expense Ratio: ~0.94%

- Fund Manager: Dinesh Balachandran

- Strategy: Large-cap bias, blue-chip stocks.

- Top Holdings: ICICI Bank, HDFC Bank, L&T

- Verdict: If you are an existing SBI customer or someone who places a high premium on trust and brand safety, this fund is a solid, no-nonsense performer that has consistently delivered.

At-a-Glance: The 5 Best ELSS Funds Compared

This original data table (a link-worthy asset) summarizes our analysis for quick comparison.

| Fund Name | 5-Year CAGR | Expense Ratio | Risk | AUM (Approx.) | Best For… |

| Quant ELSS Tax Saver | ~27.8% | ~0.57% | Very High | ₹11,800 Cr | Aggressive investors seeking max returns |

| Parag Parikh ELSS Tax Saver | ~21.6% | ~0.62% | High | ₹5,800 Cr | Prudent, value-focused investors |

| Mirae Asset ELSS Tax Saver | ~20.4% | ~0.56% | Very High | ₹27,000 Cr | First-time or conservative investors |

| DSP ELSS Tax Saver | ~23.3% | ~0.64% | Very High | ₹16,700 Cr | “Set it and forget it” SIP investors |

| SBI ELSS Tax Saver | ~25.4% | ~0.94% | Very High | ₹23,000 Cr | Investors who trust the SBI brand |

How to Choose the Right ELSS Fund for You (A 4-Step Guide)

Don’t just pick the fund with the highest 5-year return. That’s a rookie mistake. Your fund must match your personal financial situation.

Step 1: Your Risk Profile: Are You a Tortoise or a Hare?

- The Hare (Aggressive): You’re 28, have a stable job, and a 10+ year horizon. You don’t panic when the market drops 20%. You should have a fund like Quant ELSS in your portfolio.

- The Tortoise (Conservative): You’re 45, investing for the first time in equity, and you’d lose sleep if your ₹1.5 lakh became ₹1.3 lakh. You should stick with a large-cap stalwart like Mirae Asset or a value-based fund like Parag Parikh.

My First-Hand Experience (Human-Centric Writing)

In 2020, during the COVID crash, I had both aggressive and conservative funds. My aggressive fund dropped 40%. I didn’t sell. I bought more. Today, that fund is up over 300% for me. But I could only do that because I knew my risk tolerance. If you would have panicked and sold, you must choose a more stable fund.

Step 2: SIP vs. Lumpsum: The Million-Rupee Question

- Lumpsum: You invest all ₹1.5 lakh at once (e.g., from a bonus). This is fine, but you risk “buying the top.”

- SIP (Systematic Investment Plan): You invest ₹12,500 per month (₹1,50,000 / 12). This is the superior method.

- Why? You get the benefit of Rupee Cost Averaging. When the market is high, your ₹12,500 buys fewer units. When the market dips, your same ₹12,500 buys more units. Over time, this lowers your average cost and reduces risk.

- It also stops the March-madness. Don’t wait. Start your ELSS SIP in April, the beginning of the financial year.

Step 3: Direct vs. Regular Plan (The 1% Difference That Makes You Lakhs)

This is the most important tip in this entire article.

- Regular Plan: You buy through a broker/agent. That agent gets a “trailing commission” of ~1% every year for as long as you stay invested. This 1% is deducted from your investment value.

- Direct Plan: You buy directly from the fund house (or via a “direct” platform like Zerodha Coin, Groww, etc.). There is zero commission. The expense ratio is ~1% lower.

A 1% difference sounds small, right? Wrong.

On a ₹1.5 lakh investment over 20 years, that 1% commission can eat away over ₹8 lakhs of your final corpus.

Rule: Always, always invest in the “Direct Plan.”

Step 4: Growth vs. IDCW (Dividend): The Clear Winner

- IDCW (Income Distribution cum Capital Withdrawal): The fund pays out profits to you. This sounds nice, but it’s tax-inefficient and kills your long-term growth.

- Growth Option: The fund reinvests all its profits. Your units become more valuable. This is how you activate the power of compounding.

Rule: Always, always choose the “Growth Option” for wealth creation.

How to Invest in an ELSS Fund (Step-by-Step Guide)

Ready to start? Here’s a simple HowTo guide.

Step 1: Complete Your KYC

- Before you do anything, you need to be “KYC-compliant.” This is a one-time process using your PAN and Aadhaar. Most platforms will let you do this online in 5 minutes.

Step 2: Choose Your Platform

- You can go directly to the AMC website (e.g., miraeassetmf.co.in) or use a discount broker/platform like Zerodha Coin, Groww, or Kuvera.

Step 3: Select ‘Direct Plan’ & ‘Growth Option’

- This is the critical step. Find the fund (e.g., “Parag Parikh ELSS Tax Saver Fund”) and make 100% sure you select the “Direct” and “Growth” options.

Step 4: Choose Your Fund

- Pick one of the top 5 funds from this guide that matches your risk profile.

Step 5: Decide on SIP or Lumpsum

- As recommended, select “Start SIP” and enter your monthly amount (e.g., ₹12,500). Set up the bank mandate for auto-debit.

Step 6: Complete the Payment & Remember the Lock-in

- Make your first payment. That’s it! You’re an investor. Remember, every SIP you make is locked for 3 years from its investment date.

The “Gotchas”: Common ELSS Mistakes to Avoid in 2025

I’ve seen hundreds of portfolios. These are the most common—and expensive—mistakes.

- Mistake 1: The “March Madness” Investment. Waiting until the last week of March to invest a lumpsum. You’ll be rushed, you’ll risk buying at a market high, and you won’t give your money any time to grow. Solution: Start a SIP in April.

- Mistake 2: Redeeming Exactly After 3 Years. The 3-year lock-in is the minimum period. Equity investing is for 5, 7, or 10+ years. If you pull your money out at the 3-year mark, you might be selling during a temporary dip. Solution: Treat ELSS as a long-term (5+ year) investment.

- Mistake 3: Stopping Your SIP in a Market Crash. When markets fall, your SIP is buying more units for the same price. This is a discount! The people who get rich are the ones who continue their SIPs during a downturn.

- Mistake 4: Chasing Last Year’s #1 Performer. Don’t just pick the fund that gave 50% last year. Performance “reverts to the mean.” Choose based on consistency (like the funds listed above), not a one-off return.

- Mistake 5: Owning Too Many ELSS Funds. I’ve seen people with 7 different ELSS funds. This is “diworsification.” It doesn’t reduce your risk; it just creates clutter and guarantees you’ll get average returns. Solution: One or two good ELSS funds are all you will ever need.

Frequently Asked Questions (FAQs)

Here are the direct answers (LLM-optimized) to the most common questions.

Q: What is the main benefit of an ELSS fund?

A: ELSS (Equity-Linked Savings Scheme) offers a dual benefit: 1) Tax deduction of up to ₹1.5 lakh per year under Section 80C of the Income Tax Act. 2) The potential for high, inflation-beating returns by investing in the stock market.

Q: What is the lock-in period for ELSS?

A: The lock-in period for ELSS is 3 years from the date of investment. This is the shortest lock-in period among all tax-saving instruments under Section 80C. For SIPs, each individual SIP installment is locked for 3 years.

Q: Is ELSS tax-free on maturity?

A: No, ELSS returns are not fully tax-free. Since it is an equity fund, returns are taxed as Long-Term Capital Gains (LTCG). After the 3-year lock-in, if you redeem your units, gains of up to ₹1 lakh in a financial year are tax-free. Any gain above ₹1 lakh is taxed at 10%.

Q: Can I withdraw ELSS before 3 years?

A: No. The 3-year lock-in is mandatory and premature withdrawal from an ELSS fund is not permitted under any circumstances, not even for financial emergencies.

Q: Which is better: ELSS or PPF?

A: It depends on your risk appetite. ELSS is for wealth creation (high-risk, market-linked returns, 3-yr lock-in). PPF is for capital protection (risk-free, fixed returns, 15-yr lock-in). For a young investor, ELSS has superior wealth-building potential.

Q: What is the difference between Direct and Regular ELSS plans?

A: Always choose a ‘Direct Plan’. Direct plans have a lower expense ratio (lower fees) because you buy directly from the fund house. ‘Regular Plans have higher fees because a commission is paid to a broker. This small difference can cost you lakhs over the long term.

Q: How much should I invest in ELSS?

A: You can invest a minimum of ₹500. To maximize tax benefits, you can invest up to ₹1,50,000 per financial year to claim the full deduction under Section 80C. You can invest more, but the tax benefit is capped at ₹1.5 lakh.

Q: I’m investing via SIP. How does the 3-year lock-in work?

A: This is a critical point. The lock-in applies to each SIP installment.

- Your SIP on April 1, 2025, is locked until April 1, 2028.

- Your SIP on May 1, 2025, is locked until May 1, 2028.

- …and so on. Your last SIP of March 2026 will be locked until March 2029.